25 Aug How Washington State Divides Cryptocurrency in Divorce Cases

Cryptocurrency is an increasingly common asset in divorce cases. With its unique characteristics and fluctuating values, dividing cryptocurrency can add complexity to an already challenging legal process.

Complications related to cryptocurrency can vary depending on where you live. If you are divorcing in Washington, it is imperative to learn how Washington State divides cryptocurrency in divorce cases, as the approach may differ from nearby states. Use this guide to understand how to successfully navigate a divorce involving digital assets.

Washington’s Community Property Laws

Washington is a community property state, meaning courts consider nearly all assets and debts acquired during the marriage jointly owned and subject to equal division. Nevertheless, determining whether to divide cryptocurrency and how often depends on when and how partners acquired it.

For example, cryptocurrency purchased during the marriage using shared funds likely qualifies as community property. It may be separate property, though, if a spouse acquired cryptocurrency before the marriage or through inheritance.

The classification can become more nuanced in cases of cryptocurrency commingled with marital funds. For instance, suppose one partner used separate funds to purchase cryptocurrency but later mixed those funds with community assets by depositing them into a joint bank account. In such cases, it may take financial tracing to distinguish what portion belongs to each spouse.

Consult a Lawyer Who Practices Property Law

While it is commonplace to hire a lawyer for divorce proceedings, a property division attorney can help you understand your state’s property laws. At LaCoste Family Law, an attorney experienced in property division and other matters of family law can help you obtain a fair settlement of cryptocurrency and traditional assets. They can distinguish between separate and community property and help you demonstrate rightful ownership of cryptocurrency and other possessions entitled to you.

Cryptocurrency Identification and Disclosure

One of the first challenges in dealing with cryptocurrency during a divorce is identifying its existence. Unlike with traditional bank accounts or investment portfolios, it is common to store cryptocurrency holdings in digital wallets or anonymous accounts on decentralized platforms. Additionally, some cryptocurrency transactions lack traditional paper trails, making them harder to trace.

Washington courts require full financial disclosure from both parties during a divorce. This includes cryptocurrency holdings. Failure to disclose cryptocurrency could result in penalties or an adjustment to the division of other marital assets.

Uncovering undisclosed cryptocurrency may require extra diligence, such as reviewing bank or credit card statements for purchases made on exchanges. Other methods include examining blockchain records for wallet activity or even hiring forensic accountants to trace digital transactions. These efforts can be time-consuming and costly, but they may be necessary to ensure transparency.

Valuation of Cryptocurrency

Valuing cryptocurrency is another critical step in dividing it during divorce proceedings. Unlike fixed assets, cryptocurrency values can fluctuate significantly due to market volatility. This makes determining an accurate value challenging, especially in a state like Washington, where courts aim to divide assets equitably. The following key factors affect cryptocurrency valuation.

Valuation Date

Washington courts may use the date of separation, trial, or another agreed-upon date to determine the asset’s value. Rapid market changes can make the selected date highly impactful.

Exchange Rates

Cryptocurrency lends itself to trading on various exchanges, each with slightly different prices. Deciding which exchange rate to use for valuation can influence the outcome.

Conversion to Cash

If one spouse intends to cash out their share, understanding the potential gains or losses associated with the conversion is critical. Ultimately, divorcing couples may need to work with financial experts or appraisers who specialize in cryptocurrency to calculate a fair value.

Division Methods for Cryptocurrency

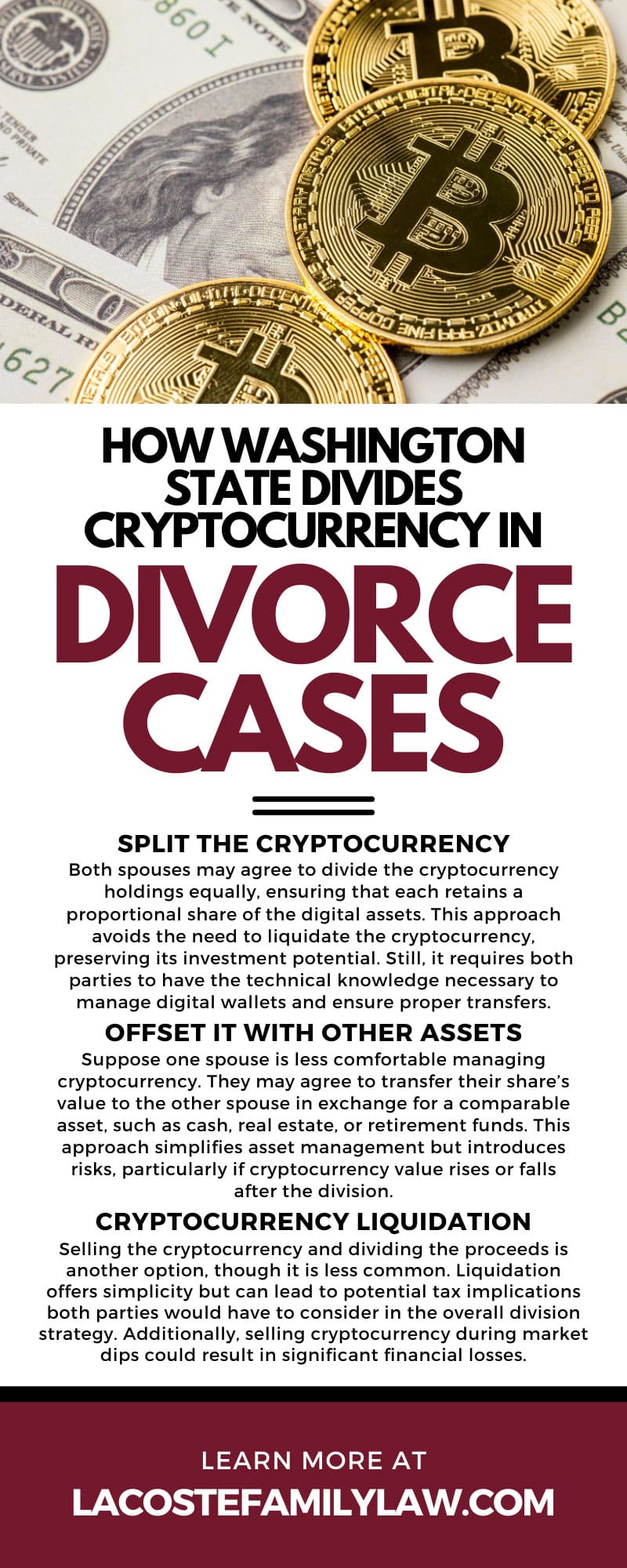

After identifying and valuing cryptocurrency holdings, the next step is determining how to divide them. Below are the methods that Washington State uses to divide cryptocurrency in divorce cases.

Split the Cryptocurrency

Both spouses may agree to divide the cryptocurrency holdings equally, ensuring that each retains a proportional share of the digital assets. This approach avoids the need to liquidate the cryptocurrency, preserving its investment potential. Still, it requires both parties to have the technical knowledge necessary to manage digital wallets and ensure proper transfers.

Offset It With Other Assets

Suppose one spouse is less comfortable managing cryptocurrency. They may agree to transfer their share’s value to the other spouse in exchange for a comparable asset, such as cash, real estate, or retirement funds. This approach simplifies asset management but introduces risks, particularly if cryptocurrency value rises or falls after the division.

Cryptocurrency Liquidation

Selling the cryptocurrency and dividing the proceeds is another option, though it is less common. Liquidation offers simplicity but can lead to potential tax implications both parties would have to consider in the overall division strategy. Additionally, selling cryptocurrency during market dips could result in significant financial losses.

Tax Considerations

Cryptocurrency introduces unique tax implications that may impact its division. Sold or exchanged cryptocurrency receives consideration as property for federal tax purposes. This means capital gains taxes may apply, depending on the asset’s appreciation. Spouses must factor these potential tax liabilities into their overall settlement strategy when dividing cryptocurrency.

For instance, if one spouse sells their share of cryptocurrency post-divorce, they may owe capital gains taxes on the increase in value since its acquisition. In another instance, cryptocurrency transferred to a spouse as part of the property settlement typically does not trigger a taxable event, but the recipient will inherit the original cost basis. Collaborating with tax professionals can help both parties avoid unexpected financial consequences.

Legal Challenges in High-Conflict Cases

Divorce cases involving hidden assets or disputes over cryptocurrency frequently require additional legal intervention. Disputes can arise over the valuation method used, allegations of hidden wallets or undisclosed transactions, or which spouse should retain certain holdings.

Washington judges have discretion to account for a spouse’s misconduct, such as hiding cryptocurrency, when deciding asset division or support obligations. If you suspect your spouse is concealing assets, turn to LaCoste Family Law for help uncovering and properly documenting them. Furthermore, when these conflicts arise, attorneys may petition the court for subpoenas, forensic examinations, or expert testimony to resolve the issue.

The Role of Pre- and Postnuptial Agreements

Prenuptial and postnuptial agreements can be significant in determining how to address cryptocurrency in a divorce. These agreements can specify whether cryptocurrency is separate or community property and how to divide newly acquired cryptocurrency assets.

Additionally, such agreements can outline the steps to take in case of hidden or inaccessible digital wallets. Couples who anticipate significant cryptocurrency holdings or fluctuations in asset value may benefit from tailoring these agreements to include detailed provisions addressing digital assets specifically.

The Importance of Professional Guidance

Cryptocurrency’s unique characteristics require careful planning and expertise during a divorce. Legal, financial, and tax professionals can all play roles in protecting your interests.

Attorneys can ensure the proper disclosure, value, and division of all cryptocurrency in accordance with Washington law. Meanwhile, financial experts and appraisers can provide insights into valuation and tax implications, paving the way for equitable settlements. Taking a deliberate and informed approach with professional guidance can lead to more balanced and less contentious outcomes.